pay utah state property taxes online

Follow the instructions at taputahgov. Online payments may include a service fee.

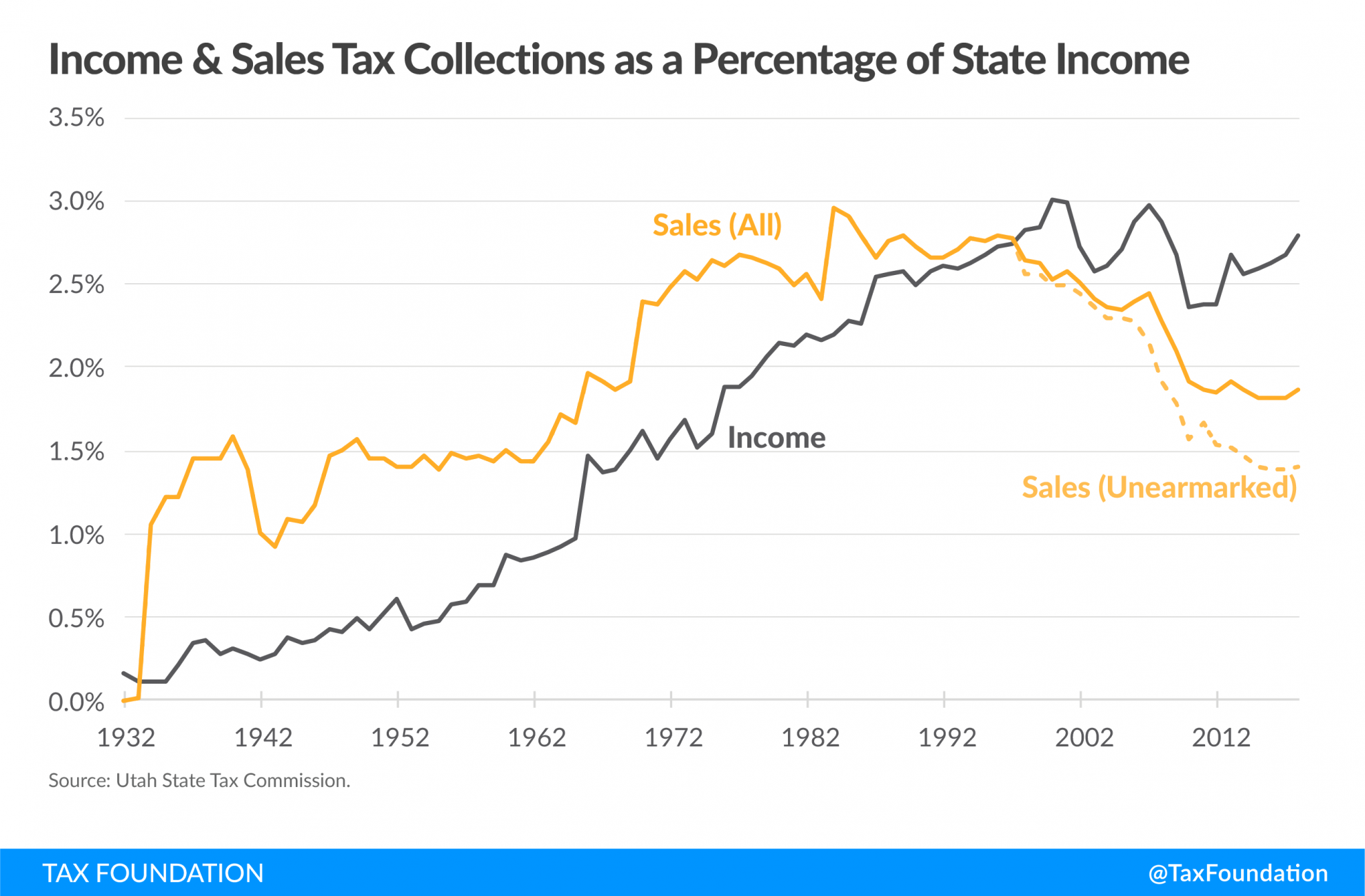

Utah Passes Tax Reform Legislation S B 2001 Tax Foundation

To find out the amount of all taxes and fees for your.

. You can also pay online and. For your protection do not send cash through the mail. File electronically using Taxpayer Access Point at.

Pay Real Property Tax Pay Business. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. Please note that for security reasons.

This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks. Pay Online You may pay your tax online with your credit card or with an electronic check ACH debit. Property Tax payments may be sent via the US Postal Service to the Treasurers Office.

Payments must be postmarked by. Click the link above to be directed to TAP Utahs. If you have questions please call 801-451-3243.

This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file. This means that for every 100000 in taxable property value the average Tooele County homeowner would pay. 1 of the payment amount with a minimum fee of 100.

You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. If you owe Utah state taxes the following instructions will guide you through the process of making an online payment. This web site allows you to pay your.

Online PERSONAL Property Tax Payment System. Online REAL Estate Property Tax Payment System. Yes you can pay your property taxes online in Utah.

You may pay your tax online with your credit card or with an electronic check ACH debit. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. You will need to create an account and login to the website.

Steps to Pay Your Property Tax. You may also pay with an electronic funds transfer by ACH credit. Filing Paying Your Taxes.

In Tooele County the average effective property tax rate is 062. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. 0 Electronic check payment.

However to pay using. We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729 Jurisdiction Code 5450. This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks.

TAP includes many free services such as tax filing and payment and the ability to manage your account online. After you login you will need to select the county in which. Payments can be made online by e-check ACH debit at taputahgov.

Filing Utah State Taxes Things To Know Credit Karma

Utah County Raises Property Taxes 67 Ke Andrews

Utah Tax Break Program Could Be A Lifeline For Seniors

Property Valuation Notice Utah County Clerk Auditor

Pay Taxes Utah County Treasurer

State By State Guide To Taxes On Middle Class Families Kiplinger

Fillable Online Abc Utah Utah State Tax Commission 210 N 1950 W Salt Lake City Ut 84137 Fax Email Print Pdffiller

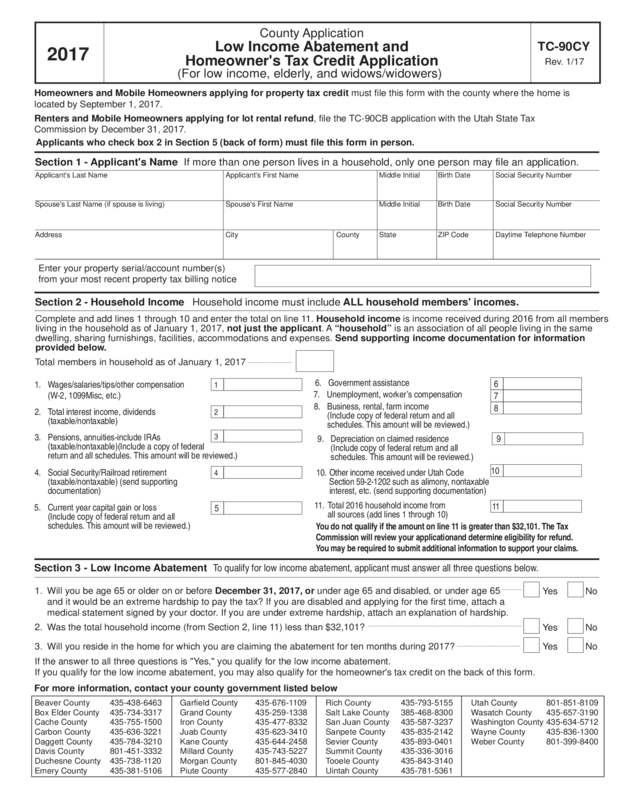

Tc 90cy Utah State Tax Commission Edit Fill Sign Online Handypdf

How Taxes On Property Owned In Another State Work For 2022

Free Utah Bill Of Sale Forms 4 Pdf Eforms

Utah Property Taxes Utah State Tax Commission

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How Do State And Local Sales Taxes Work Tax Policy Center

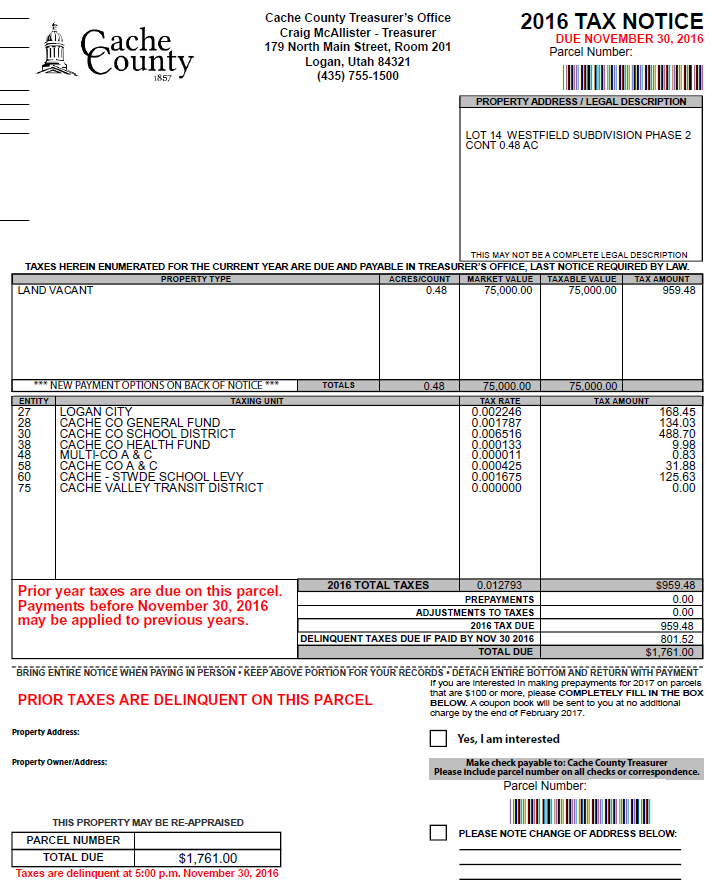

Official Site Of Cache County Utah Paying Property Taxes

Do I Have To File State Taxes H R Block

Property Taxes How Much Are They In Different States Across The Us